Price-without-VAT-for-woocommerce/price-wo-vat.php at master · novetrendy/Price-without-VAT-for-woocommerce · GitHub

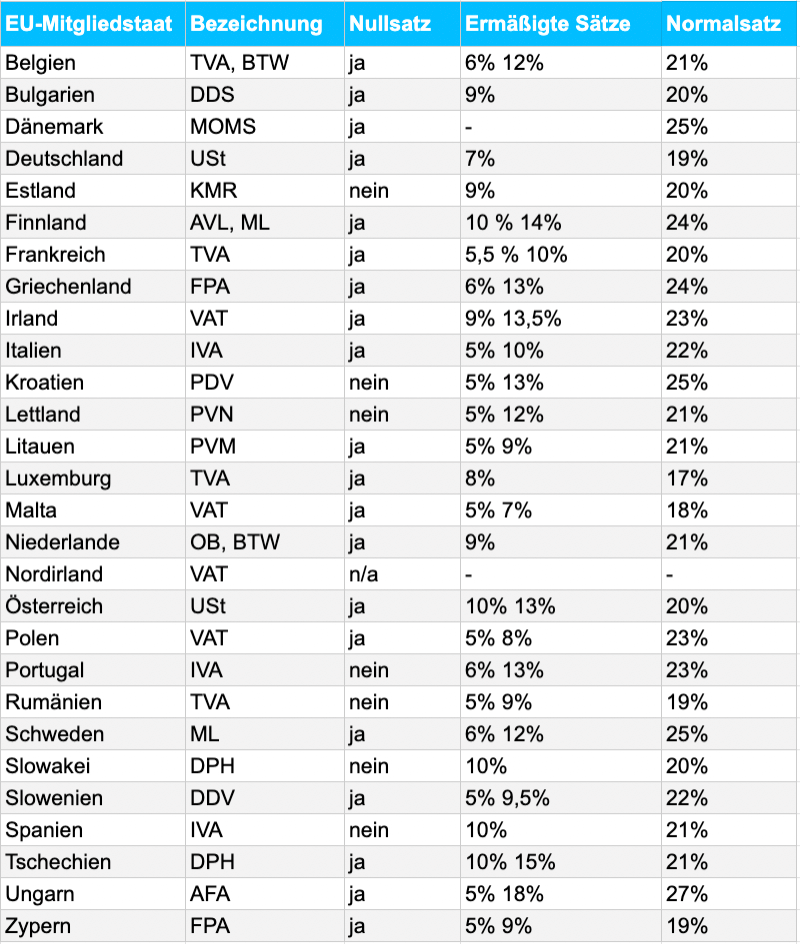

Product Update 405/406: Change of Cash Slip due to VAT change from 14% and 20% to 15% and 21% (Czech Republic)

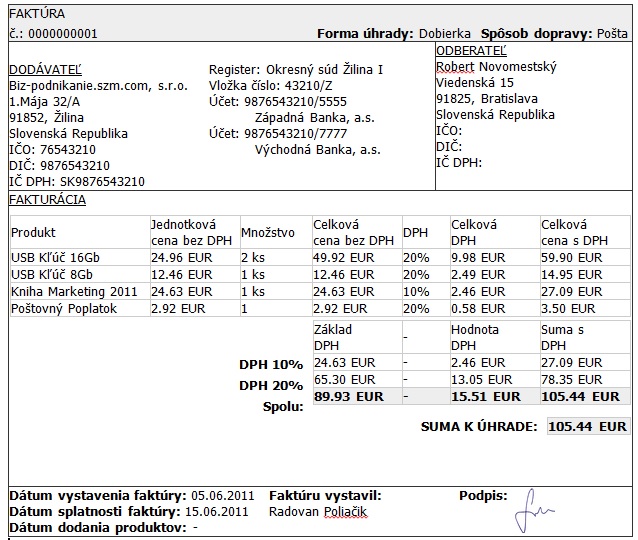

Product Updates 421, 420, and 419: VAT return form for financial year 2020 available (Slovak legislation)

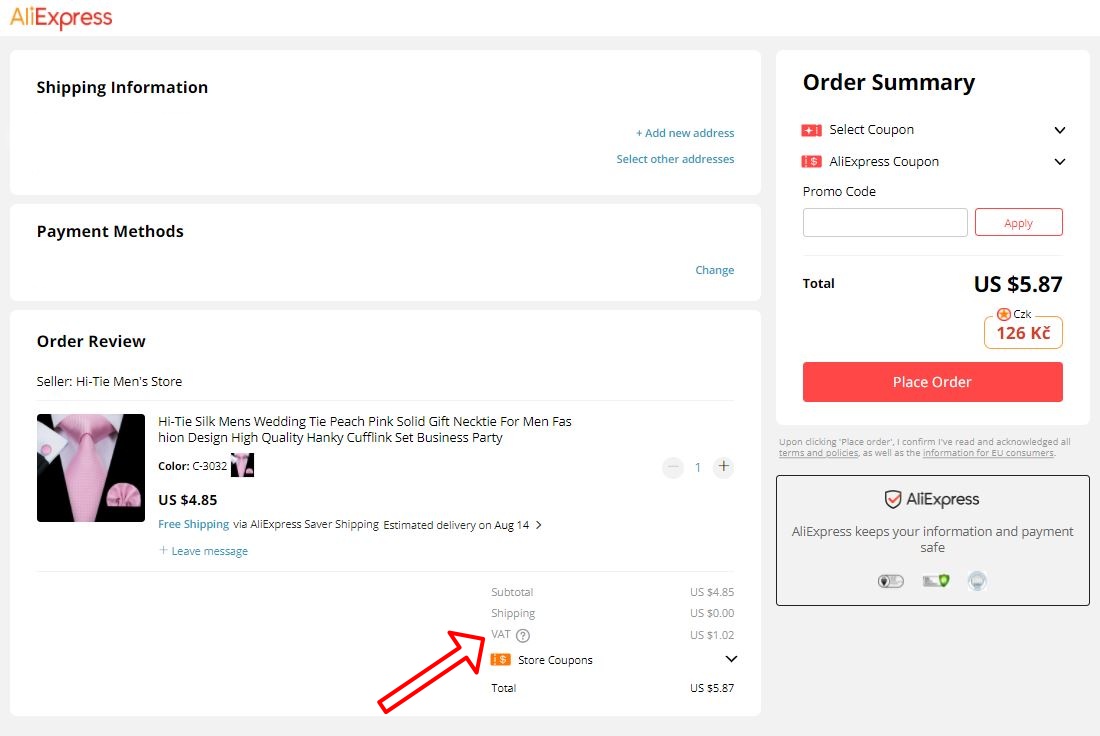

INSTRUCTIONS: This way you can buy from China without VAT and customs even after the application of the new law from July 2021 - Xiaomi Planet