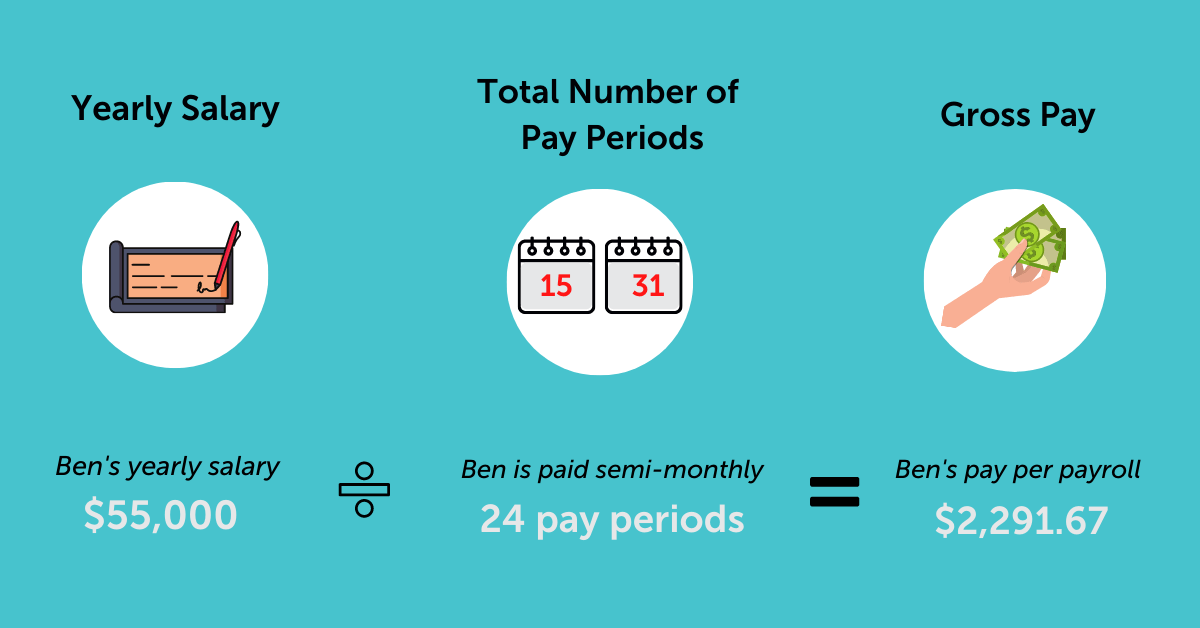

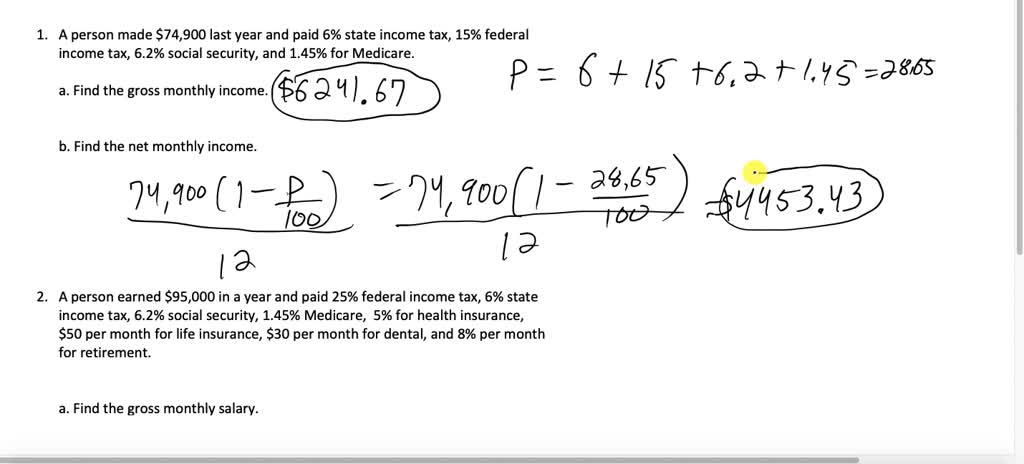

SOLVED: Jennifer made 74,900 last year. She pays 6% state income tax, 15% federal income tax, 6.2% for social security,a nd 1.45% for medicare. a. What was her gross monthly income? b.What

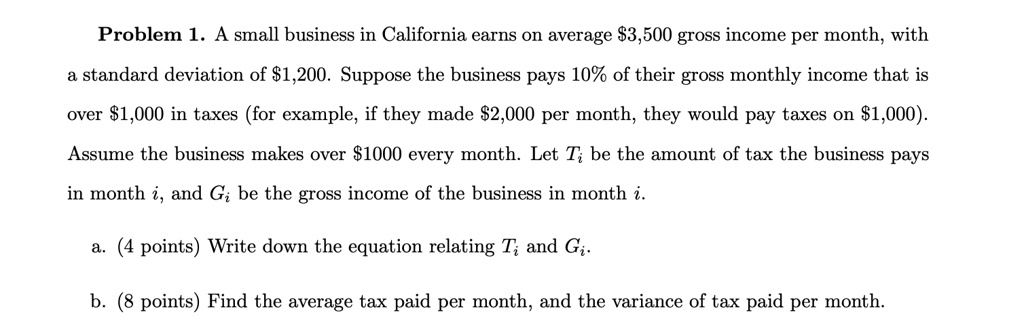

SOLVED: Problem 1. A small business in California earns on average 3,500 gross income per month; with standard deviation of 81,200. Suppose the business pays 10% of their gross monthly income that

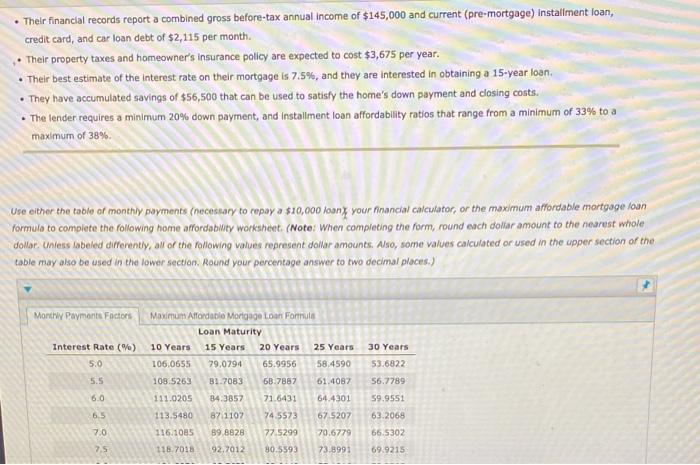

:max_bytes(150000):strip_icc()/grossincome-ea78c4765b7b48999138d5512646f591.jpg)

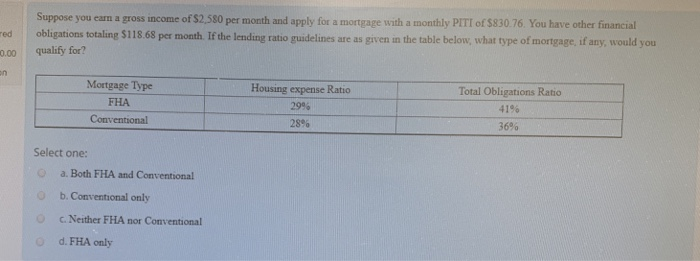

![How to Calculate Gross Monthly Income [With Examples] - Money Tamer How to Calculate Gross Monthly Income [With Examples] - Money Tamer](https://moneytamer.com/wp-content/uploads/2022/01/calculate-gross-monthly-income-from-annual-salary-1024x683.jpg)

![How to Calculate Gross Monthly Income [With Examples] - Money Tamer How to Calculate Gross Monthly Income [With Examples] - Money Tamer](https://moneytamer.com/wp-content/uploads/2022/01/gross-monthly-income-from-weekly-paycheck-1024x683.jpg)