ESTIMATION OF INTERNATIONAL TAX PLANNING IMPACT ON CORPORATE TAX GAP IN THE CZECH REPUBLIC. - Document - Gale Academic OneFile

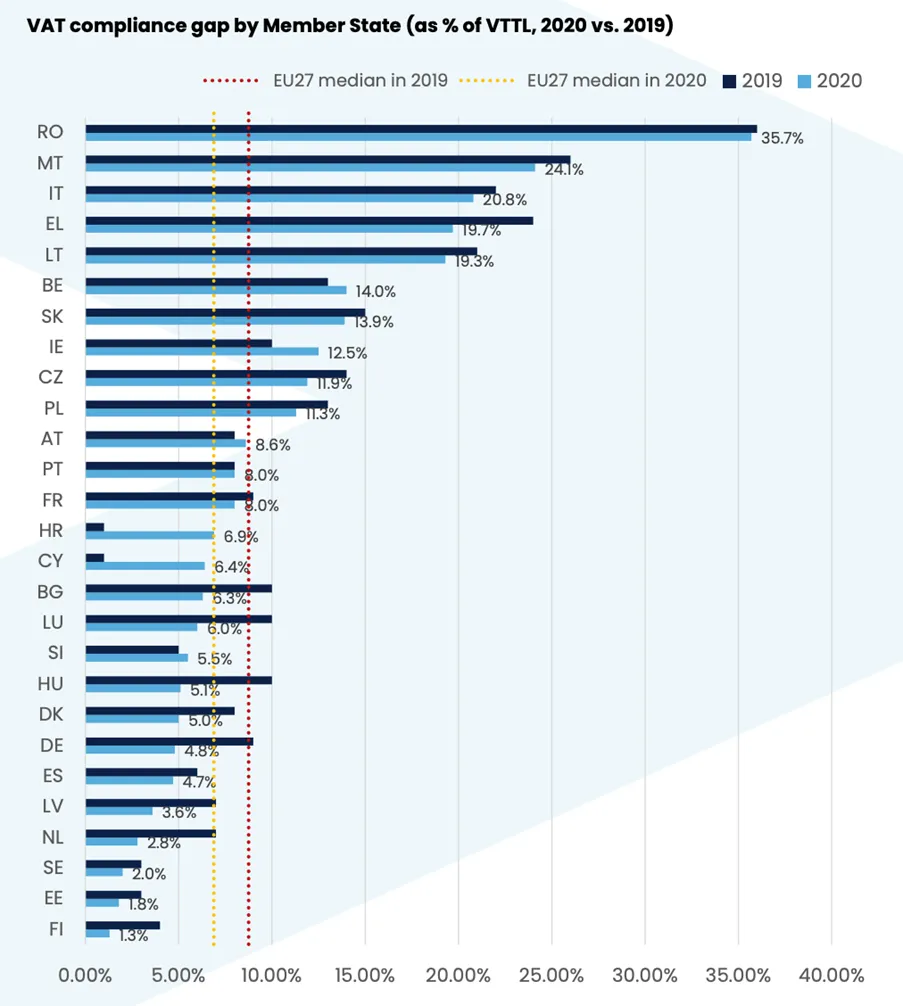

Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

VAT Gap in Poland: policy problem and policy response The goal of proposed research project is to comprehensively examine the ev

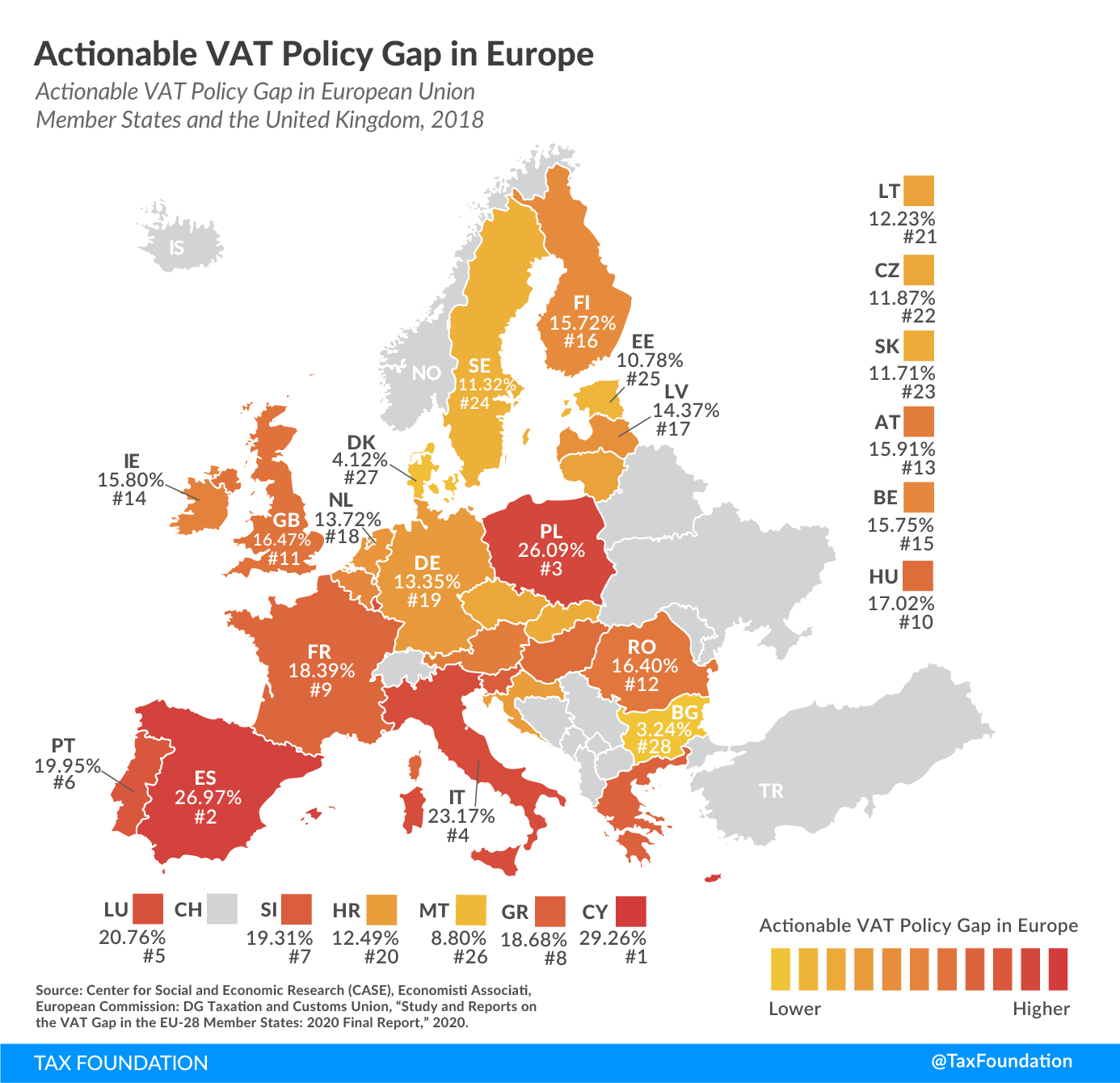

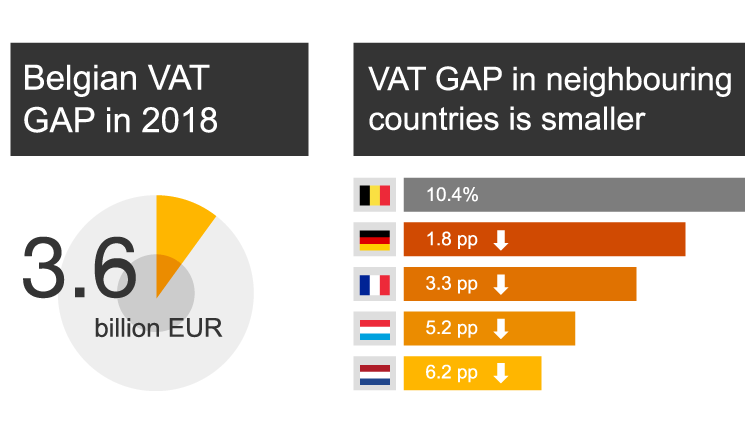

Sustainability | Free Full-Text | VAT Efficiency—A Discussion on the VAT System in the European Union

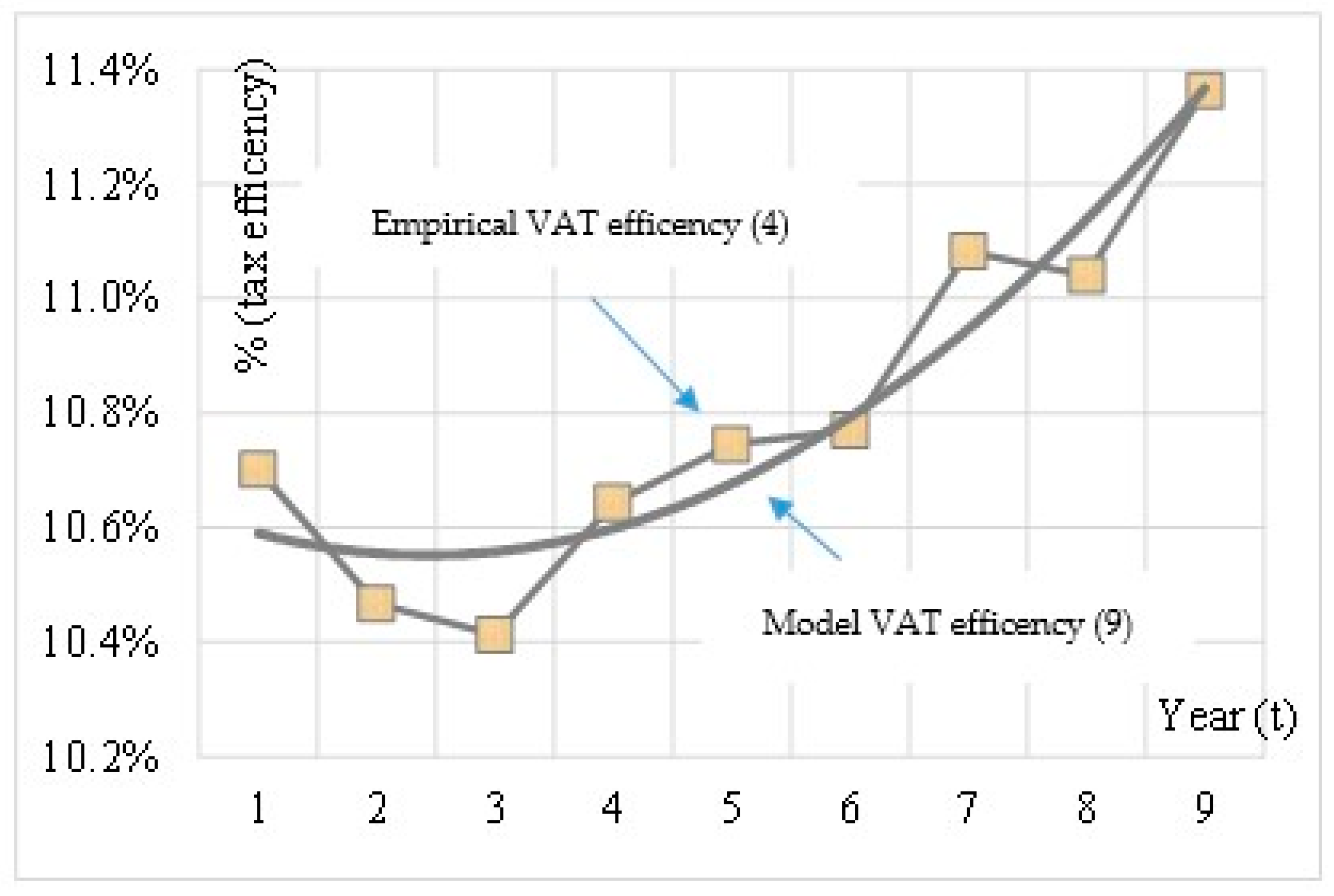

Alternative method to measure the VAT gap in the EU: Stochastic tax frontier model approach | PLOS ONE

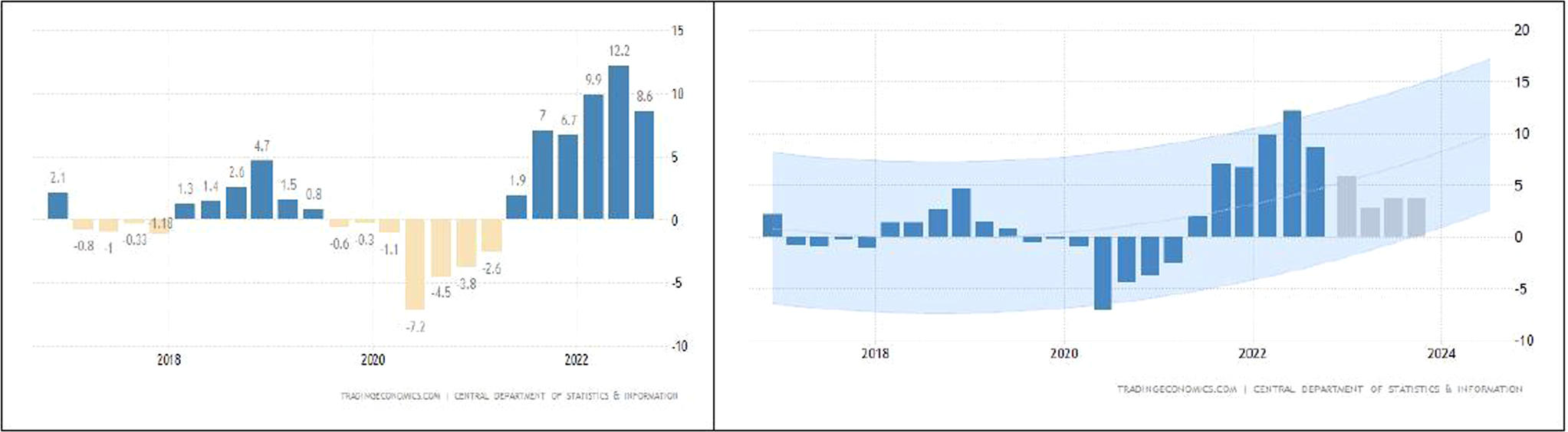

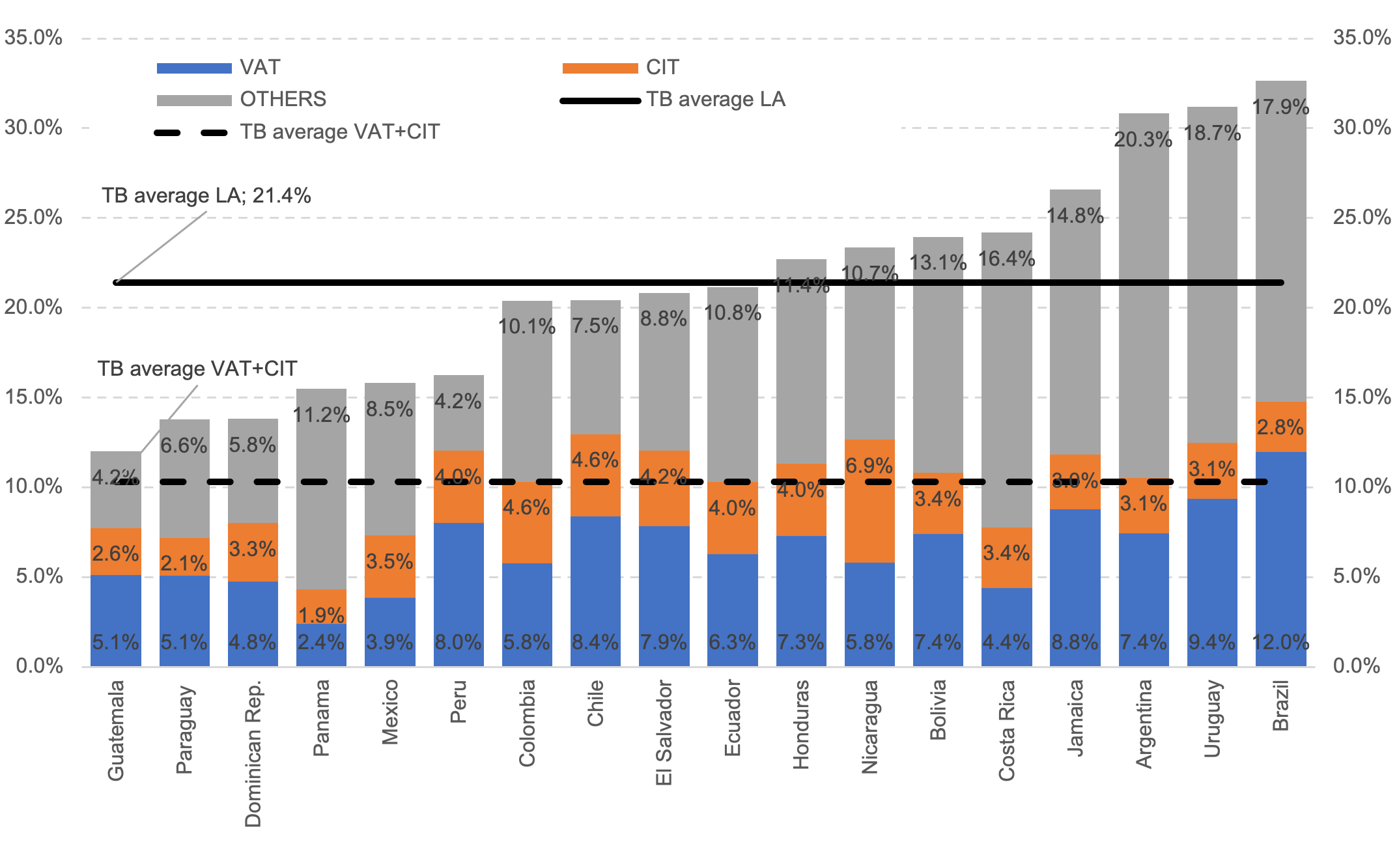

Revenue Efficiency of Value Added Tax and Corporate Income Tax | Inter-American Center of Tax Administrations