Amazon.com: Value Added Risk Management in Financial Institutions: Leveraging Basel II & Risk Adjusted Performance Measurement: 9780470821152: Belmont, David P.: Books

Evaluation of Basel III revision of quantitative standards for implementation of internal models for market risk – topic of research paper in Economics and business. Download scholarly article PDF and read for

Value at Risk model for credit risk under Basel II Source: Aikman et... | Download Scientific Diagram

Value at Risk model for credit risk under Basel II Source: Aikman et... | Download Scientific Diagram

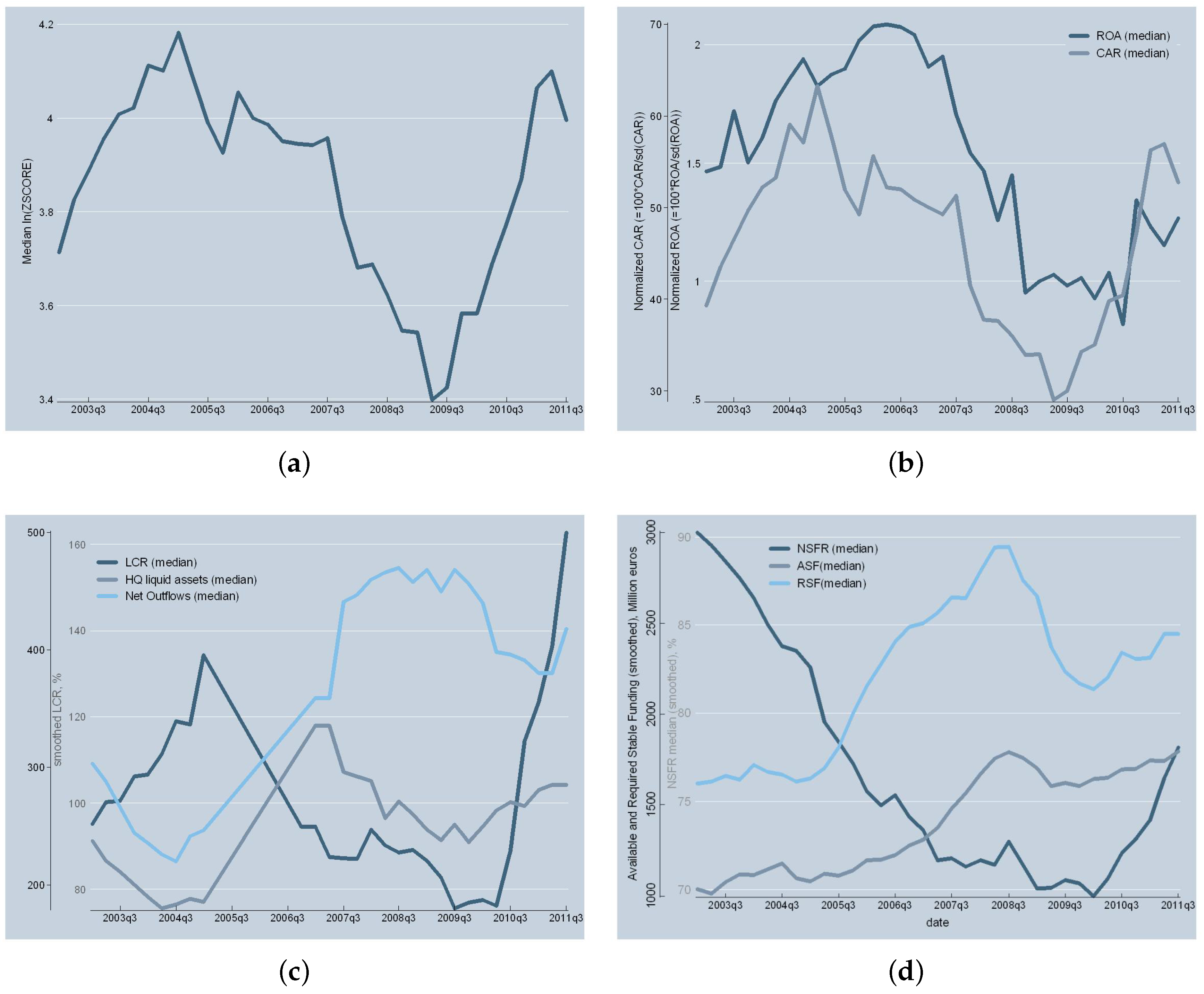

JRFM | Free Full-Text | An Empirical Study on the Impact of Basel III Standards on Banks' Default Risk: The Case of Luxembourg

![PDF] An Evaluation of the Effectiveness of Value at Risk ( VaR ) models for Australian Banks under Basel III | Semantic Scholar PDF] An Evaluation of the Effectiveness of Value at Risk ( VaR ) models for Australian Banks under Basel III | Semantic Scholar](https://d3i71xaburhd42.cloudfront.net/e035c9e7b74b464876b6ebfb51a3f75844345b21/14-Figure1-1.png)

PDF] An Evaluation of the Effectiveness of Value at Risk ( VaR ) models for Australian Banks under Basel III | Semantic Scholar

:max_bytes(150000):strip_icc()/riskweightedassets.asp-final-752d387734924e54871f7f69f150bdbe.png)